Weekly Crop Commentary - 08/08/2025

Aug 08, 2025

Haylee VanScoy

Director of Grain Purchasing

StoneX released their crop survey estimates earlier this week, pegging Ohio’s corn yield at 191 bushels per acre and soybeans at 56. Conversely, Ohio's Country Journal’s crop tour was notably lower at 178 and 52, respectively. The reality will likely land somewhere in between—I’d peg it closer to 187 on corn and 55 on beans. Driving around Mechanicsburg, Delaware, Marysville, and Kenton areas this week, overall conditions looked pretty solid for this time of year. The earlier–planted fields look nice, but we said that last year, so we’ll see how the final stretch of August weather plays out to finish up this crop.

On the market side, new crop corn lost around 7¢ on the board this week, recovering slightly from Wednesday’s dip below $4.00. Basis levels, however, have continued to erode. Soybeans have also faced pressure again today. They’ve traded sideways most of the week as the market awaits fresh headlines. We’ll watch weather updates and the August WASDE next Tuesday. November ’25 futures are still about 15¢ above their early April lows, but another day or two like today, and we’ll quickly be back there. As harvest approaches, I strongly encourage you to connect with your local merchandiser to review your marketing plan, identify targets, and consider contract types that provide downside protection. Wishing you all a wonderful weekend.

Lisa Warne

Grain Merchandiser, Marysville (Region 4)

Happy Friday! Yesterday’s market had everything in the green, but we’re closing the week in the red again. Old crop corn has felt the effects of basis fading quickly. Processors have dramatically cut back on their bids, apparently having bought enough bushels to get them closer to harvest.

Analysts are throwing out their projected yield estimates before next Tuesday’s USDA August crop production report. StoneX’s customer survey came up with a record 188.1 corn yield, compared to last month’s USDA number at 181. StoneX shows soybeans at 53.6 versus the USDA’s 52.5 bushels per acre. StoneX had Ohio at 191 corn, in drastic contrast to Ohio's Country Journal’s crop tour average of 178. The bean figures were also slightly different, with StoneX’s Ohio figure at 56 and OCJ’s at 52 bpa. Will USDA increase its yield and production numbers next week? Some figure that a higher yield is already built into the market, but we’ll determine when/if the market reacts at noon on Tuesday.

We’re getting more questions about what to do with unpriced new crop bushels this fall. In the past several years, the basis has weakened as we head into, and during, harvest. Doing a basis contract early is one way to avoid DP charges without setting the futures part of the equation. Alternatively, use DP to carry the bushels into the new year then transfer to a basis contract when it should start to improve, and that would stop DP charges. We also have other alternative contract options to discuss. Contact your area’s grain merchandiser to discuss different strategies. Have a great weekend!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon. Fair season is in full swing around the state, and next up, we'll look at the fall harvest. Where has the time gone?

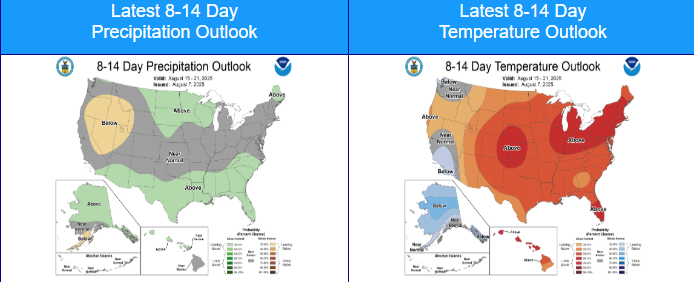

The grain markets continue to work lower as we stare at what could be a huge corn crop across the US. StoneX published the results of their first survey on Monday, and they have the national average on corn at 188.1 bu per acre for a 16.323 billion bu crop. Beans came in at 53.6 bu per acre, making that a 4.425 billion bu crop. In the July report, USDA has 181 bu per acre corn and 52.5 bu per acre beans. Tuesday is the August update from USDA, so we will get a fresh set of numbers from them. I think the bean yield has room to be lower yet. We all know that in August, yields are determined by rain. Below, I have attached the latest 8-14 day precipitation and temperature outlook maps, issued yesterday by the National Weather Service. The precipitation is just normal, and the temperatures will get pretty warm. Most places need a drink right now, so that will be a story to continue to watch.

In closing, if we see a bump in prices over the next few weeks due to a scare in the market place, I would recommend having some targets in place so if the markets spike, you get some coverage. Give any of us a call to talk a little more in detail about what is going on. I hope all of you have a great weekend.